October is here, and if you’ve been following crypto long enough, you know what that means.

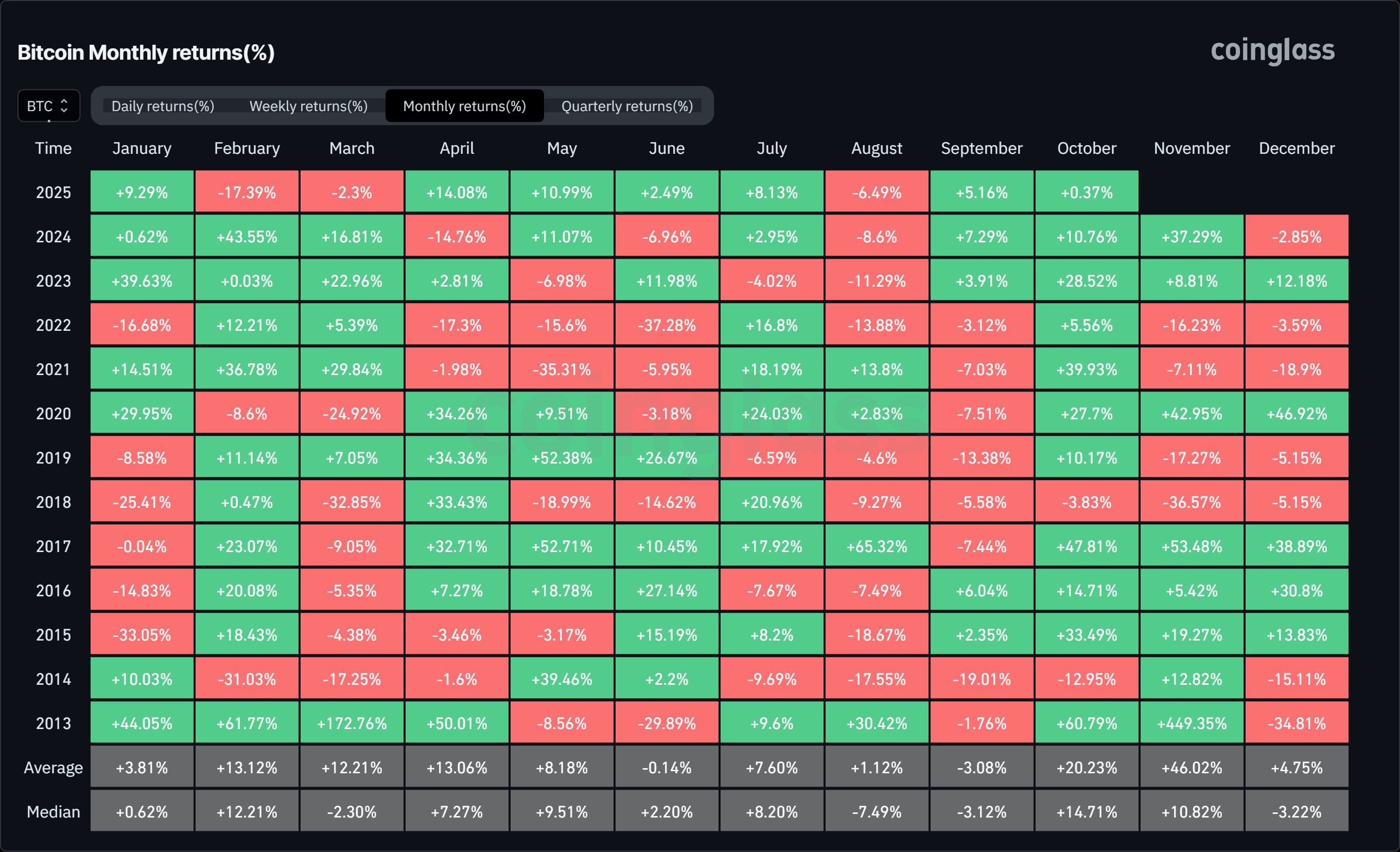

Historically, October has been one of the best months for Bitcoin, averaging 22% gains and posting green candles in 10 of the last 12 years. But here’s what gets me excited: we’re 18 months post-halving, which is exactly when the fireworks started in 2017 and 2021.

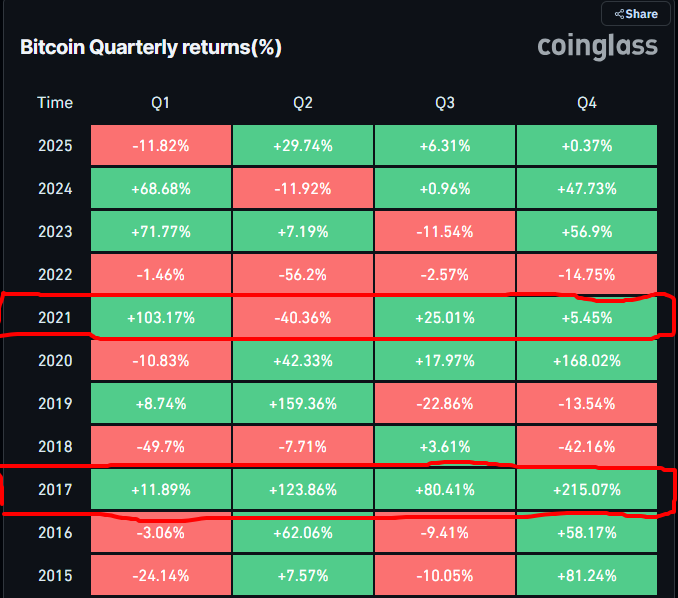

Q4 of those post-halving years delivered 215% and 5% respectively, for Bitcoin, with altcoins going absolutely parabolic.

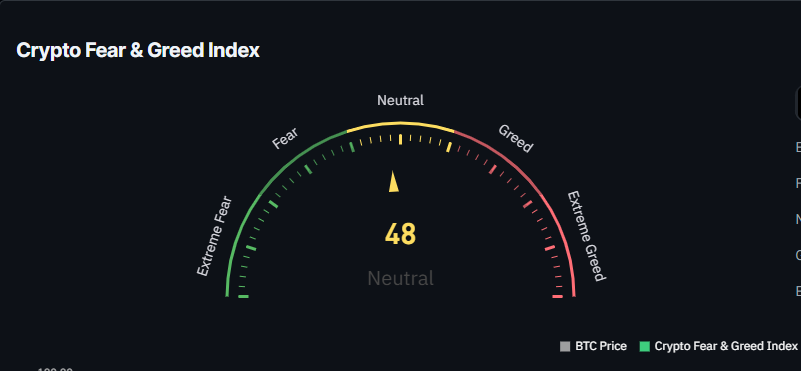

Right now? The Fear and Greed Index is sitting at 39. That’s fear territory, even with Bitcoin hovering around $114,000. Google searches for “altcoins” have dropped 55% from their August peaks.

Everyone’s nervous, which historically has been exactly when you want to be paying attention.

The Fed just cut rates and has two more cuts projected before year-end. M2 money supply hit record highs.

And Bitcoin dominance is at 59%, which means once it starts rolling over, capital is going to flow hard into altcoins.

So, let’s discuss five projects I’m watching closely as we head into Q4. These aren’t moonshot gambles; these are coins with real catalysts converging in October and fundamentals strong enough to perform if this market heats up.

1. STBL

What it is: STBL is the governance token of a stablecoin protocol that just launched a few weeks ago. Trading around $0.33 with a $166 million market cap.

Why I’m watching it: Franklin Templeton, a massive asset manager with billions under management, just invested $100 million in USTT, which is the stablecoin that STBL governs

Stablecoins are going to be one of the narratives doing very well into this peak cycle. A lot of people are finally looking at stablecoins as a way to navigate the crypto space, and when an institution like Franklin Templeton puts $100 million behind it, that’s validation.

We were looking at this around $0.15 in our Telegram. It went all the way to $0.60 and has been consolidating in this 30-cent range. The fully diluted valuation sits at $3.2 billion, but some of the tokens coming into circulation actually won’t be entering circulation—the next STBL unlock will be held in Treasury, locked, and staked.

What’s happening in Q4: They’re starting buyback and burns of the STBL token. That’s a deflationary mechanism that creates value for holders. They also have ecosystem growth plans and product development rolling out.

This project literally launched just a few weeks ago, so it’s relatively new. But the $100 million Franklin Templeton investment is making a lot of people pay attention.

My take: If you like the stablecoin narrative, keep this on your radar. It’s small enough to move significantly but backed by real institutional money.

2. Plasma

What it is: Plasma is a purpose-built L1 blockchain for stablecoins. Trading at $0.94 with a $1.7 billion market cap.

Why I’m watching it: The adoption we’ve seen over the last week as Plasma launched has been massive. In the span of just a couple of days, we’ve had seven billion dollars of stablecoins come into this chain.

That’s a whole lot of money moving onto a single L1. There are protocols and even memecoins on Plasma now that you can get into depending on your risk appetite. A bunch of people made a lot of money on airdrops with Plasma, so that’s something to consider as well.

What makes it interesting: This is an L1 in the stablecoin narrative, which ties into the broader trend I mentioned with STBL. We could continue seeing adoption in the stablecoin markets during Q4, and who knows if big institutions decide to launch stuff on Plasma via stablecoins.

My take: The $7 billion TVL influx in just days is the kind of momentum you want to see. If the stablecoin narrative heats up in Q4, Plasma is positioned to benefit directly. Keep your eyes on this one.

3. Aster

What it is: Aster is a perpetual DEX that’s being shilled and backed by CZ, the previous CEO of Binance. Trading around $1.64 after pulling back from $2.40, sitting at a $2.71 billion market cap.

Why I’m watching it: If you’ve been living under a rock, perpetual DEXs have been the talk of the town recently. This is one of the narratives currently doing very well, and Aster is the one to look at.

Binance is also kind of shilling this. Aster is competing against Hyperliquid, and a lot of whales from Hyperliquid have moved over to Aster. Volume is going through the roof right now.

October catalyst: There’s going to be another airdrop in the early parts of October for people utilizing the Aster Perpetual DEX. That’s driving a lot of the current volume and attention.

My take on perp DEXs: When a narrative is running and one specific coin is doing well, it’s not necessarily wise to fade it and try to catch the beta play. That number one player usually continues to run, especially when it’s being shilled by someone as influential as the ex-CEO of Binance.

You could trickle down to other perpetual exchanges, there’s Hyperliquid, Edge, Paradox, Apex (which just announced a $12 million token buyback). But the main play right now is Aster.

My take: Perpetual DEXs like Aster are definitely worth monitoring into Q4. The volume is real, the October airdrop creates a clear catalyst, and CZ’s backing brings legitimacy. Just keep in mind that money flows from narrative to narrative, so this could rotate if perp DEXs cool off.

4. Avalanche

What it is: Avalanche (AVAX) is an established Layer 1 blockchain trading at around $30. I keep talking about this one because I think it’s well-positioned heading into Q4.

Why I’m watching it: Let’s look at what happened to AVAX back in April. It went all the way down to $15 when everything was going through the roof, and there was a lot of negative news on crypto.

From those $15 lows, we’ve basically 2X’d on AVAX since April. Just over the last few days, it even went up to $35.

We’re not in altcoin season yet,we’re not seeing a lot of new large caps do very well aside from BNB and Solana. But AVAX at $30? I still think it’s going to do much better than that when altcoin season actually arrives.

What I like about it: AVAX is well-positioned in the gaming space, plus they have several partnerships with key Web2 companies. That’s important for real adoption beyond just crypto natives.

You can also go down the risk curve with AVAX beta plays, there are smaller tokens in the Avalanche ecosystem that could amplify returns if AVAX performs well in Q4.

My take: This is one of the larger-cap coins I’m watching. It’s less risky than the newer launches, it’s already proven it can bounce from lows, and the gaming narrative plus Web2 partnerships give it multiple ways to win. Definitely staying on my watch list for Q4.

5.Aerodrome Finance

What it is: Aerodrome Finance is the liquidity hub of Base—the main decentralized exchange of the Base ecosystem. Trading around $1.07, sitting just shy of a $1 billion market cap.

Why I’m watching it: This is one of my personal favorite coins. I think the Base ecosystem is going to do very well this cycle, and Base has already done extremely well. But I think momentum is going to continue.

The big integration: Aerodrome has integrated DEX trading into Coinbase’s exchange. That’s huge. Coinbase has millions of users, and now they can access Aerodrome liquidity directly through the Coinbase app.

I think this is just a matter of time before it blows up. It was at $0.99 just a few days ago, bounced back to $1.07, and I can see this being in the billions of dollars in market cap. Right now it’s just shy of $1 billion—that psychological barrier is right there.

My take: If you’ve been following the channel, you know I’ve been talking about Aerodrome. The Coinbase integration is the key catalyst here. When altcoin season really gets going and Base ecosystem coins start running, Aerodrome as the main DEX is going to capture that volume.

This is definitely one I’d be betting on for Q4. Of course, not financial advice—you need to do your own research.

How I’m Thinking About These Picks

Look, there are a bunch of altcoins out there. I can’t talk about every single one. I wanted to highlight some newer ones that grabbed liquidity during the recent dull period (STBL, Plasma, Aster) and some established larger-cap plays (AVAX, Aerodrome).

It all depends on your risk-to-reward ratio. If you’re very risky, you’re probably not even looking at these coins; you’re going more degenerate with smaller-cap plays. But if you want to be risk-averse, these are solid options to consider.

The meta right now: You can have a bag of stablecoins and play the new launches. That’s kind of the current strategy. Some of these launches are going to continue doing well in Q4, but you can also go back to the older coins and larger-cap plays.

None of this is financial advice. Just because I’m talking about a coin doesn’t mean you should go buy it. Everyone has a different financial situation, and you need to do your own research.

The Setup Is There

We’re heading into Q4 with historical precedent on our side. October averages 22% gains for Bitcoin. Q4 of post-halving years has delivered 85% average returns for Bitcoin and 24% for Ethereum.

Fear and Greed Index at 39 shows people are nervous. Google search interest for altcoins is at rock bottom. Bitcoin dominance at 59% means rotation is coming once BTC starts consolidating.

The Fed is cutting rates. M2 money supply indicators suggest we could see consolidation into early October, but after that, momentum could pick back up based on the 70-day lag theory.

These five projects, STBL with Franklin Templeton backing, Plasma with $7 billion in stablecoin TVL, Aster with CZ’s support and an October airdrop, AVAX already up 2X from April lows, and Aerodrome approaching $1 billion market cap—all have specific reasons to watch them this quarter.

It’s good to have some capital on the side to pounce on opportunities as they launch or as momentum comes back to certain plays. But these are the ones on my watch list heading into what could be a very interesting Q4.