What You Need to Know Before Investing in Altcoins

Look, I’m not here to tell you these coins are going to make you rich.

I’m also not going to pretend crypto isn’t one of the most volatile, unpredictable markets out there. Because it absolutely is.

But what I can do is walk you through 10 cryptocurrency projects that are seeing significant development activity and market interest right now.

These aren’t random picks from page 47 of CoinMarketCap. These are projects with real teams, real technology, and real reasons why investors are paying attention.

You’ll notice I’m not throwing around price predictions or telling you to mortgage your house. That’s not what this is about.

This is about understanding what these projects actually do, why they matter in the broader crypto ecosystem, and what makes them different from the thousands of other coins out there.

Important: Crypto remains highly speculative. Prices can drop 50% in a week. Projects that look promising can fail.

If you’re thinking about investing in any of these, do your own research. Talk to people who know more than you do. And never invest more than you can afford to lose completely.

With that out of the way, let’s dive into the top altcoins worth watching.

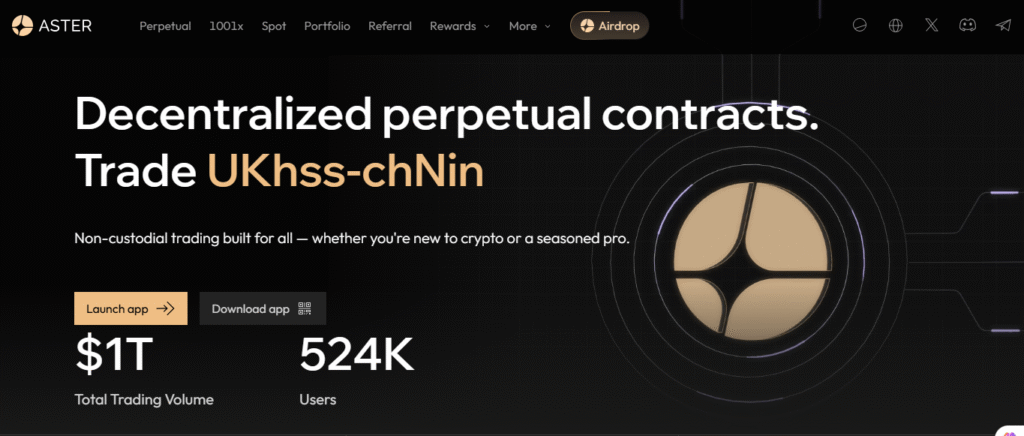

1. Aster (ASTER): Decentralized Trading Platform

What Is Aster Crypto?

Aster is a decentralized perpetual exchange for cryptocurrency trading. Think of it like a trading platform where you can buy and sell futures contracts and spot assets, but instead of going through a centralized company like Coinbase or Binance, you’re trading directly through blockchain technology.

Why Investors Are Watching Aster

Aster offers cross-chain trading without the usual hassle. Normally, if you want to trade on different blockchains, you have to bridge your assets back and forth. That’s slow, expensive, and sometimes risky. Aster eliminates that.

You can trade across

- Ethereum

- Solana

- BNB Chain

- Arbitrum

All with one click.

Aster Trading Features

The platform supports some pretty powerful tools

- Hidden orders for traders who don’t want everyone seeing their moves

- Grid trading for automated strategies

- 100x leverage on tokenized US stocks like Apple or Tesla, all settled in crypto

Aster Performance Metrics

The numbers are impressive for a new platform.

Aster hit 500 billion in trading volume shortly after launch. Now, I’ll be honest with you, nobody knows exactly how much of that is real organic trading versus artificial volume pumping. But even accounting for that, it’s significant traction.

Current stats

- Over 2 million users

- $400 million in total value locked

- Backed by CZ (former Binance CEO)

The platform runs on the ZK-optimized Aster chain, which means fast execution without MEV (miner extractable value) problems. Basically, front-running bots can’t easily manipulate your trades.

Should You Buy Aster?

Right now, Aster just launched and most major exchanges haven’t listed it yet. That means if you wanted to buy it, you’d have to jump through some hoops.

Accessibility is limited, which cuts both ways – fewer people can buy it, but that also means there’s potential for more exchange listings to drive interest.

2. Chainlink (LINK): Oracle Network for Smart Contracts

What Is Chainlink Cryptocurrency?

If you’ve been in crypto for more than five minutes, you’ve probably heard of Chainlink.

It’s been around for years, and honestly, it’s one of those projects that doesn’t get enough credit for how essential it is to the entire DeFi ecosystem.

Here’s what Chainlink does: it connects smart contracts to real-world data.

Why DeFi Needs Chainlink

Think about it this way. A smart contract on Ethereum can’t just go out to the internet and check the price of Bitcoin or the weather in Chicago or the score of last night’s game. Blockchains are isolated systems. They need something called an “oracle” to feed them external information.

That’s Chainlink.

Major DeFi protocols rely on Chainlink:

- Aave

- Lido

- Jupiter

When you’re lending $100 million worth of crypto and you need to know the exact price to calculate liquidations, you can’t have that data being manipulated. Chainlink provides that security.

Chainlink Network Scale

The network is processing over $25 trillion in transaction value.

Beyond Price Feeds: Chainlink’s Evolution

But Chainlink has evolved way beyond just price feeds.

They launched CCIP (Cross-Chain Interoperability Protocol). This enables seamless data and value transfers across different blockchains. They’re also working on advanced computation services, privacy tech, and connecting old-school legacy banking systems to blockchain networks.

Recently, they launched Guard Nav in collaboration with Aave. It’s a risk-adjusted oracle for pricing tokenized real-world assets.

As more traditional assets get tokenized – think bonds, real estate, commodities – someone needs to price them accurately on-chain. That’s what Guard Nav does.

Chainlink Partnerships and Institutional Adoption

The partnerships here are next leve:

Tech Giants:

- Google Cloud

- Amazon Web Services

- Oracle

Financial Institutions:

- Swift (international banking)

- Fidelity

- UBS

- JPMorgan

- Mastercard

These aren’t just press release partnerships where nothing actually happens. These are active integrations where Chainlink is connecting tradfi systems to blockchain infrastructure.

Chainlink Token Economics

From a token perspective, Chainlink has a fixed supply of 1 billion tokens with about 60% currently circulating.

They’ve created something called the Chainlink Reserve, which uses revenue from the network to buy back LINK tokens. In a recent update, they accumulated over 47,000 tokens in a single buyback.

Is Chainlink a Good Investment?

Here’s my take: as traditional finance continues embracing blockchain – and it is, whether crypto purists like it or not – Chainlink becomes more essential. Every smart contract that needs real-world connectivity is probably going to use Chainlink in some capacity.

It’s infrastructure. It’s not sexy. But it’s necessary.

3. Near Protocol

What Is Near Protocol?

Near Protocol is a layer one blockchain that’s positioning itself at the intersection of AI and crypto.

I know, I know. “AI” is the buzzword that gets slapped on everything these days. But hear me out.

Near has been building infrastructure specifically for AI agents, autonomous programs that can own assets, make transactions, and interact with blockchain protocols without human intervention.

Let me give you a practical example.

Imagine an AI agent that manages a DeFi portfolio. It needs to swap tokens, provide liquidity, stake assets, and move money across different chains.

Normally, that would require complex programming and multiple manual approvals. Near’s chain signatures feature enables AI agents to do all of this seamlessly without bridges or complicated workarounds.

From a technical standpoint, Near is impressive.

The nightshade 2.0 upgrade pushed the network to 10,000 transactions per second. They’re targeting 100,000 TPS by the end of the year. Transaction finality happens in about 1.2 seconds with low fees.

The user numbers are substantial: 46 million monthly active users and $218 million in DeFi total value locked.

Near was built by a team of developers who previously worked on major tech platforms. The codebase reflects that it’s designed to be developer friendly with tools that make it easier to build complex applications.

Partnerships include Amazon Web Services, Google Cloud, Circle, and Deutsche Telekom as a validator. They recently integrated with Everclear, which processes over $1 billion in cross-chain stablecoins.

The token has a supply of 1.2 billion with nearly all of it in circulation. There’s 5% annual inflation, but most of that gets burned through transaction fees, creating deflationary pressure.

Here’s what’s interesting about Near: it’s trading significantly below its all-time high. At its peak, NEAR was over $20. Right now it’s a fraction of that.

Does that mean it’s undervalued? Not necessarily. Lots of projects from the last bull run never recovered their highs.

But it does mean there’s technically more room for price appreciation if AI adoption in crypto actually takes off the way people think it will.

4. Sui

Sui is one of those projects that gets the “next Solana” label thrown around a lot.

I try not to put too much stock in those comparisons because they’re usually just marketing hype. But in Sui’s case, there are some legitimate technical parallels worth discussing.

Sui was built by former Meta engineers who worked on the Diem project – Facebook’s failed attempt at creating a cryptocurrency. When that project got shut down, the team took what they learned and built Sui.

What makes Sui different from most blockchains is its architecture.

Most blockchains process transactions sequentially – one at a time. Sui uses an object-centric data model with the Move programming language that enables parallel transaction processing. Multiple transactions can happen simultaneously without conflicting with each other.

In controlled tests, Sui has handled up to 300,000 transactions per second with sub-400 millisecond finality. Real-world swap transactions complete in about 700 milliseconds with fees under a penny.

The growth metrics show real adoption: over $2 billion in total value locked, 31 million active accounts, and daily DEX volumes that hit $368 million during peak periods in Q2.

Developer activity is strong with over 5,000 monthly builders. The ecosystem includes tools like ZK login, which allows gasless entry for new users – basically making it easier for non-crypto people to start using applications built on Sui without needing to understand wallets and private keys.

Recent launches include Sui Play, which is a blockchain-native gaming console, and the Birds app with 5 million users that gamifies DeFi participation.

Partnerships include Google (through their AI payments protocol), Microsoft for enterprise integration, and Mastercard for virtual cards accepted at over 20,000 merchants.

Here’s something worth noting: there’s a Sui ETF filing in the US. If approved, that opens the door for institutional investors and traditional portfolios to gain exposure to Sui without actually holding the token themselves.

The tokenomics show 10 billion total supply with 35% currently in circulation, vesting through 2030. The network burns 2% annually through transaction fees, creating some deflationary pressure.

Sui is currently trading at around $11 billion market cap, which is about 55% below its all-time high.

My honest assessment? Sui has legitimate technology and real developer interest.

Whether that translates to price appreciation depends on a lot of factors outside the technology itself; market conditions, narrative momentum, competition from other L1s. But as far as layer one blockchains go, Sui is executing well.

5. XRP

XRP is probably the most controversial coin on this list.

People either love it or absolutely hate it. There’s not much middle ground.

Here’s what you need to know without the tribalism: XRP is a payment focused cryptocurrency developed by Ripple specifically for cross-border transactions.

Ripple’s on-demand liquidity system processes about $1.3 trillion in quarterly volume. Banks and financial institutions use it to settle international payments quickly and cheaply. The XRP Ledger handles transactions in under five seconds with minimal fees.

The big story with XRP over the past few years was the SEC lawsuit. The SEC claimed Ripple sold XRP as an unregistered security. That lawsuit dragged on forever, tanking XRP’s price and creating massive uncertainty.

In 2023, the court ruled that XRP is NOT a security when sold to retail investors. Ripple paid a $50 million penalty, and that was it. Regulatory clarity.

Now here's why that matters.

With that legal cloud lifted, institutions that were hesitant to touch XRP can now consider it. Exchange listings that were paused got restored. ETF applications are being filed.

XRP is ISO 20022 compliant. If you’re not familiar with ISO 20022, it’s the new international standard for financial messaging that banks are transitioning to by November this year. XRP’s compliance with this standard positions it for adoption as that migration happens.

Ripple has partnerships with over 300 financial institutions including Santander, American Express, SBI Holdings (which started using XRP for payments), Moneygram, and many others.

The team behind Ripple includes people with serious traditional finance credentials. Brad Garlinghouse, the CEO, previously held senior positions at Yahoo and AOL. Rosie Rios, the 43rd US Treasurer who oversaw $13 trillion in US currency operations, is on their board.

XRP has a total supply of 100 billion tokens with 55% currently in circulation. Ripple holds a significant portion in escrow, releasing a set amount monthly. Whatever doesn’t get sold goes back into escrow. This has been a point of criticism – people worry about supply overhang.

Right now XRP is trading around $2.80, which is up significantly from the $0.55 range during the SEC lawsuit, but still well below previous all-time highs.

Here’s my take: if you believe traditional finance is going to increasingly use blockchain rails for payments and remittances, XRP is positioned for that. If you think crypto should be completely decentralized and separate from banks, you probably hate everything XRP represents.

Your call.

6. Stellar Lumens (XLM): Financial Inclusion Blockchain

What Is Stellar and How Is It Different from XRP?

Stellar is basically XRP’s younger sibling with a different philosophy.

It was actually founded by Jed McCaleb, one of Ripple’s co-founders, back in 2014. After leaving Ripple, he created Stellar with a specific mission: financial inclusion for unbanked populations worldwide.

Stellar vs XRP: Key Differences

The technology is similar to XRP in many ways:

- ISO 20022 compliant network

- 1,000 transactions per second

- Near-zero fees

- Sub-five-second finality

But there are some key differences.

Stellar is run by a nonprofit organization called the Stellar Development Foundation. It’s not trying to maximize profit. The goal is genuinely about providing financial infrastructure for people who don’t have access to traditional banking.

Stellar Network Statistics

The network has grown to:

- $150 million in total value locked

- Over 9 million active enterprise wallets**

Stellar’s Built-in DEX and Smart Contracts

What makes Stellar interesting is its built-in DEX. You can swap assets directly on the Stellar network without needing a separate exchange.

It also has smart contract capabilities through something called Soroban, which enables DeFi applications, tokenization, and CBDC pilots.

Major Companies Using Stellar

Recent integrations are notable:

PayPal launched their stablecoin (PYUSD) on Stellar in June. Franklin Templeton brought their $446 million tokenized US treasury fund to Stellar.

These aren’t small players experimenting – these are major traditional finance companies choosing Stellar as their blockchain infrastructure.

Stellar CBDC Projects

Stellar is also being used for CBDC initiatives. Multiple countries including Ukraine, Peru, and Brazil are testing or using Stellar for central bank digital currency projects.

Stellar Partnerships

Partnerships include:

- IBM

- Moneygram

- Circle

- Various financial institutions worldwi

Stellar Leadership Team

The team is solid:

- Danielle Dixon (CEO) – previously led Mozilla, World Economic Forum advisor

- Jed McCaleb (Chief Architect) – remains involved

XLM Token Supply and Deflation

XLM has a total supply of 50 billion tokens with 30 billion currently in circulation. Transaction fees get burned, creating deflationary pressure over time.

XLM Price Analysis

Stellar trades at around $0.40 right now with a market cap of about $12 billion. It’s up significantly from its bear market lows but still well below previous highs.

Is Stellar a Good Investment?

Here’s what I think: Stellar has found its niche in tokenized real-world assets and financial inclusion. As more traditional assets get tokenized and put on blockchain, Stellar is positioning itself as the infrastructure layer for that transition. Whether that translates to price appreciation for XLM is a separate question, but the use case is legitimate.

7. Ondo Finance (ONDO): Real World Asset Tokenization

Ondo is one of the most interesting projects in the real-world asset tokenization space.

While everyone was chasing meme coins and NFT hype, Ondo was quietly building infrastructure to bring trillions of dollars worth of traditional assets onto blockchain.

Here’s what they do: Ondo tokenizes real-world assets like US treasuries, bonds, and money market funds, making them accessible on-chain for DeFi applications.

Their main fund alone has over $1.2 billion in market cap. Total value locked across their ecosystem hit $1.6 billion as of September, up over 200% year on year.

Think about what this enables.

You can now use tokenized US treasuries as collateral for DeFi loans. You can earn yield on tokenized bonds while still having the liquidity to trade or move those assets. You can combine the security and backing of traditional finance with the efficiency and programmability of DeFi.

Ondo built their own blockchain called Ondo Chain specifically for institutional-grade tokenization. It’s permissioned, meaning only approved assets and users can participate, which helps with regulatory compliance.

They also run Flux Finance, a lending platform offering about 4.3% APY with $167 million in total value locked. It enables overcollateralized loans using tokenized assets.

Ondo Global Markets launched with $242 million TVL in its first week, enabling cross-chain yields and institutional access to tokenized securities.

The partnerships here signal where this is going.

Aave integrated Ondo for real-world asset collateral. Mastercard partnered with them for non-US payment solutions. They’re positioning themselves right at the center of the multi-trillion dollar asset management industry’s move onto blockchain.

BlackRock, the world’s largest asset manager, has been tokenizing money market funds. JPMorgan is experimenting with blockchain bonds. Ondo is infrastructure that makes all of this possible at scale.

The team comes from top-tier traditional finance backgrounds. Nathan Altman, the CEO, spent over 15 years at Goldman Sachs in structured products. Pinku Surana was a product manager at Coinbase. They have advisors who are former BlackRock executives.

ONDO token has a total supply of 10 billion with about 30% currently in circulation, gradually vesting through 2030.

Right now Ondo trades below $1 with roughly a $3 billion market cap.

Here’s my assessment: real-world asset tokenization is not a “maybe” – it’s happening.

The question is which platforms will dominate that space. Ondo is positioning itself as infrastructure.

If the $100 trillion traditional asset management industry moves even 5% onto blockchain over the next decade, the platforms facilitating that are going to capture significant value.

Whether that value accrues to ONDO token holders is something you’d need to research more deeply. But the thesis is solid.

8. Sei (SEI): Trading Optimized Blockchain

What Is Sei Network?

Sei is a layer one blockchain built specifically for trading and DeFi applications.

Most blockchains try to be general-purpose – good at everything, great at nothing. Sei took a different approach. They optimized specifically for high-frequency trading and financial applications.

The technical specs reflect this focus.

Sei’s twin turbo consensus enables 22,000 orders per second with sub-300 millisecond finality. For context, Ethereum processes about 15 transactions per second. Sei is designed to handle order book-style trading at speeds that rival centralized exchanges.

The network has grown to $2.5 billion in total value locked with 1.2 million daily active wallets and over $500 million in daily DEX volume.

What makes Sei unique is features like parallelized EVM (so it can process multiple transactions simultaneously) and enclave tech that prevents MEV exploitation.

If you’ve ever had a trade front-run on Ethereum, you know how frustrating that is. Sei’s architecture makes that much harder to do.

The platform powers DEXs and lending protocols, with recent integrations including Aave for tokenized collateral and Binance for futures trading.

There’s also a VanEck ETP filing for Sei, which would provide institutional access similar to how Bitcoin and Ethereum ETFs work.

The team includes engineers from Robinhood, Uber, Google, and Meta. These are people who’ve built high-performance trading infrastructure at scale for major tech companies.

SEI token has 10 billion total supply with 60% in circulation, vesting through 2030.

Sei currently trades at around a $2 billion market cap below $0.30.

My take: if on-chain trading continues growing – and it is – specialized infrastructure like Sei that can handle high-frequency activity will become more valuable.

The question is whether Sei captures enough of that market compared to competitors. But the specialization strategy is smart.

9. Hedera Hashgraph (HBAR): Enterprise Blockchain

What Is Hedera Hashgraph?

Hedera is one of those projects that doesn’t get talked about much in crypto circles but has quiet, serious adoption in enterprise environments.

Instead of using traditional blockchain architecture, Hedera uses something called Hashgraph technology. Without getting too deep into the technical weeds, it’s a different type of distributed ledger that enables faster throughput and energy efficiency.

Hedera can process 10,000 transactions per second with ultra-low fees (fractions of a penny) and finality in seconds. It’s designed for supply chain tracking, tokenized assets, carbon accounting, and enterprise applications.

The network holds $114 million in total value locked with about 500,000 daily transactions and 42 billion tokens in circulation.

What’s unique about Hedera is its governing council model.

Instead of being fully decentralized or controlled by a single company, Hedera has a council with rotating seats held by major corporations.

Google, IBM, Boeing, and others have representation. This provides stability and institutional confidence, though it raises questions about true decentralization.

The use cases are interesting because they’re real-world, not just crypto-native.

Swift (the international banking system) has tested cross-border payments on Hedera.

Nvidia is collaborating on secure AI data. Various tokenized credit funds and stablecoin projects have launched on the network.

Recently, Wyoming launched a stablecoin project on Hedera. Apollo Management launched a $50 million tokenized fund. These are substantial, regulated financial products choosing Hedera as their infrastructure.

There are multiple ETF applications filed for HBAR from firms like Canary Capital and Grayscale, with analysts giving them high approval odds.

The team includes people who pioneered distributed ledger systems. Leemon Baird, co-founder and chief scientist, invented the Hashgraph technology and holds patents on consensus mechanisms.

HBAR has a fixed supply of 50 billion tokens with 42 billion currently in circulation. Transaction fees get burned, creating deflationary pressure.

Hedera trades around $0.21 with roughly a $10 billion market cap.

Here’s my assessment: Hedera is playing a long game with enterprise adoption. If you believe the future of blockchain includes major corporations and government entities using this technology for supply chains and finance, Hedera has positioned itself well for that.

If you think crypto should be purely decentralized and anti-establishment, the governing council model probably bothers you.

10. Base Chain

Base is an Ethereum Layer 2 built by Coinbase, and here’s why it’s on this list despite not having a token yet: they just announced they’re exploring launching one.

Let me back up.

Base launched as a scaling solution for Ethereum. It’s an optimistic rollup that increases transaction speed to over 10,000 per second with subsecond finality and minimal fees.

It’s EVM-compatible, meaning developers can easily port Ethereum applications over to Base.

The traction has been impressive even without a native token.

Base has $5 billion in total value locked, over 20 million monthly active addresses, and more than 1 million daily users. Major DeFi protocols like Uniswap and Aave are deployed on Base. Over 5,000 developers are actively building on the network.

Here’s what changed: at Base Camp 2025, the team announced plans to explore a native token for decentralized governance and user incentives.

This sparked immediate speculation about an airdrop.

If you’re not familiar with how airdrops work: when a blockchain launches a token, they often reward early users by giving them free tokens based on their activity.

People who used Arbitrum before their token launch received thousands of dollars worth of ARB tokens. Some users made over $100,000 from that single airdrop.

Base has similar potential.

The advantage Base has over other Layer 2s is the Coinbase connection. They have access to 110 million Coinbase users for onboarding. They have US regulatory compliance through Coinbase. And they have brand recognition.

No tokenomics have been released yet. No launch date has been announced. But speculation points to Q1 2026 based on the timeline mentioned at Base Camp.

Here’s what people are doing: they’re actively using Base to potentially qualify for an airdrop. Trading on Base DEXs, providing liquidity, using Base applications, bridging assets over – all of this creates on-chain activity that could factor into airdrop calculations.

Is this guaranteed to work? Absolutely not. The team could decide not to do an airdrop. They could use different criteria. They could allocate mostly to developers instead of users.

But the potential is there.

My take: Base’s growth without a token shows organic adoption. When they do launch a token, the attention will be massive. Whether that creates a good entry point or causes immediate sell pressure from airdrop recipients is anyone’s guess. But it’s worth watching closely.

Final Thoughts

These 10 projects represent different corners of the crypto ecosystem.

You’ve got DeFi infrastructure like Chainlink and Aster. Payment-focused networks like XRP and Stellar.

Layer 1 blockchains like Sui, Near, Sei, and Hedera. Real-world asset tokenization through Ondo. And a Layer 2 opportunity with Base.

Understanding what these projects do is valuable whether you invest in them or not. It helps you see where crypto development is actually happening versus where the hype is loudest.

A few closing reminders:

Technology doesn’t guarantee investment returns. Plenty of technically superior projects have failed while inferior ones succeeded.

Market timing, liquidity, narrative momentum – all of these matter as much as the underlying tech.

Do your own research. I’ve given you starting points, but you need to dig deeper if you’re seriously considering any of these.

Read the documentation. Check the GitHub activity. Talk to people who actually use these platforms.

And understand the risks. Crypto is volatile. Prices can crash. Projects can fail. Regulations can change. Security breaches happen.

If you’re going to invest in any of this, make sure it’s money you can genuinely afford to lose completely without impacting your life.

The crypto space is fascinating from a technology perspective. Whether it translates to investment success is a different question entirely.

Do with this information what you will.

1 Comment

Pingback: What Is Cryptocurrency? Beginner’s Guide 2025 - cryptogiant