The question “what is blockchain” might be difficult to answer for many, but that might be because it’s not been properly explained.

Have you ever wondered if that online purchase would actually arrive? Or questioned whether a concert ticket reseller is legitimate? These everyday trust problems are exactly what blockchain technology solves – and being able to answer the question “what is blockchain” for beginners doesn’t require a computer science degree.

Blockchain is a distributed digital ledger that records transactions across many computers simultaneously. Each transaction is grouped into a “block” and linked to previous blocks, forming a “chain” that is nearly impossible to alter.

It creates a transparent, secure system for exchanging information or value without requiring a central authority like a bank.

This guide breaks down blockchain technology in simple terms, using real-world analogies and practical examples. Whether you’re curious about cryptocurrency, interested in blockchain applications, or exploring career opportunities, you’ll finish this article with a solid understanding of how blockchain works and why it matters.

- What Is Blockchain? A Simple Explanation for Complete Beginners

- How Does Blockchain Work? Step-by-Step Process

- Key Features That Make Blockchain Technology Special

- Real-World Blockchain Applications Beyond Cryptocurrency

- Blockchain vs Cryptocurrency: Understanding the Difference

- Advantages and Disadvantages of Blockchain Technology

- What This Means for Your Future (Industry Impact)

- Frequently Asked Questions About Blockchain

- Next Steps: Continue Your Blockchain Learning Journey

- About This Guide

- Reference

What Is Blockchain? A Simple Explanation for Complete Beginners

At its core, blockchain technology is a new way of recording and sharing information that doesn’t require a central authority to verify truth. Unlike traditional systems where a single organization controls the records – like your bank keeping track of your account balance – blockchain distributes this responsibility across thousands of computers worldwide. Each computer holds an identical copy of the records, and they all work together to verify new information before adding it permanently.

The Problem Blockchain Solves: Trust Without Middlemen

Every day, we rely on trusted intermediaries to function in society. Banks verify we have money before processing payments. Governments confirm our identity through passports and licenses. Companies track product authenticity with certificates.

Lawyers validate property ownership through title searches. These middlemen are necessary in our current system because strangers can’t trust each other directly.

But what if there was a way to establish trust through mathematics and transparency instead of institutions? That’s exactly what blockchain technology provides – a system where trust emerges from verifiable processes rather than from trusting a single authority.

The Google Doc Analogy: Understanding Blockchain Simply

Here’s the simplest way to understand “what is blockchain:” Traditional databases are like a Microsoft Word document. Only one person can edit it at a time, and they have to email copies around to share it.

Each recipient gets their own version, but there’s no single source of truth – someone could change their copy without anyone else knowing, creating confusion about which version is correct.

Blockchain is more like a Google Doc where:

- Everyone has access to view the same document simultaneously

- Multiple people can verify any changes being made

- There’s a complete, permanent history of every edit that’s ever been made

- No one can secretly alter past entries without everyone noticing immediately

- No single person controls or owns the document

Think of it another way: imagine a physical ledger book where each page is connected to the previous one with unbreakable locks. You can’t tear out a single page without everyone noticing because the locks would be broken.

You can’t use correction fluid to change an old entry because everyone has an identical copy of the book and would see that your copy doesn’t match theirs. That’s essentially how blockchain works – except with mathematics instead of physical locks.

This isn’t a perfect comparison (blockchain is more secure and complex), but it captures the fundamental shift in how we think about shared information: from isolated copies controlled by one party to a shared, verifiable truth that no single entity can manipulate.

Blockchain Meaning: Your Digital Ledger Explained

Let’s break down the terminology. A ledger is simply a record-keeping book, like an accountant might use to track income and expenses. A digital ledger is the computerized version. What makes blockchain special is that it’s a distributed digital ledger – copied across many computers rather than kept in one place.

The name “blockchain” comes from how this ledger is structured:

Blocks are like pages in a ledger book. Each block contains a list of transactions (Sarah paid James $100, Mike bought a car, etc.) along with a timestamp and unique identifier.

Chain refers to how these blocks are connected. Each new block contains a mathematical reference to the previous block, linking them together in chronological order. This creates an unbreakable chain of records stretching back to the very first transaction.

If someone tried to change an old transaction, it would break the mathematical links in the chain, immediately alerting everyone in the network that something’s wrong.

How Does Blockchain Work? Step-by-Step Process

The best way to understand how blockchain works is to follow a single transaction from start to finish. Let’s watch what happens when Sarah wants to send money to James using blockchain technology.

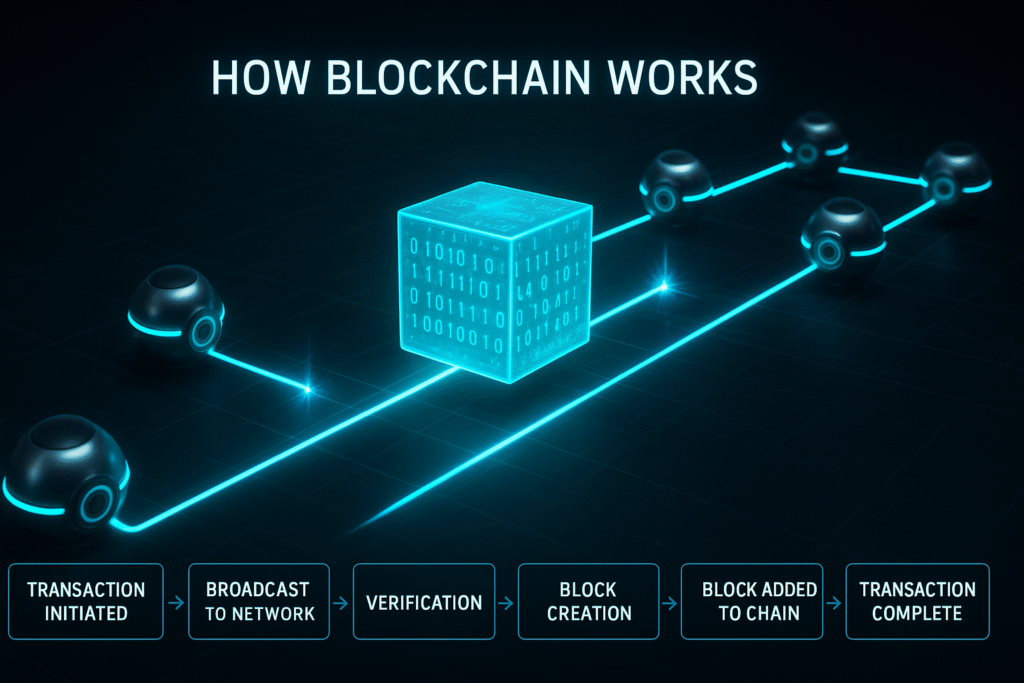

How Blockchain Transactions Work: The Complete Process

- Transaction Initiated: Sarah requests to send $100 to James through the blockchain network using her digital wallet

- Broadcast to Network: The transaction is announced to all computers (called nodes) participating in the blockchain network

- Verification: Network participants validate that Sarah actually has $100 to send using cryptographic algorithms and checking the transaction history

- Block Creation: Sarah’s verified transaction is grouped with other recent transactions that are also waiting to be processed into a new “block”

- Block Added to Chain: The new block is permanently added to the existing blockchain with a timestamp and unique cryptographic identifier

- Transaction Complete: James receives the $100, and the permanent record of this transaction cannot be altered or deleted

This entire process typically takes anywhere from a few seconds to several minutes, depending on the specific blockchain network being used.

Understanding Blocks: The Pages in Your Digital Ledger

Each block in the blockchain contains three main components that make the system secure:

Transaction data is the actual information being recorded – in our example, “Sarah sends $100 to James.” But a single block usually contains hundreds or thousands of transactions, not just one.

Timestamp records exactly when the block was created, establishing a chronological order that can’t be disputed later.

Unique identifier (called a “hash”) acts like a fingerprint for this specific block. It’s a long string of numbers and letters generated by a mathematical formula that processes all the information in the block. Even changing a single letter in one transaction would completely change this fingerprint, immediately revealing that someone tampered with the records.

Think of blocks as pages in a ledger book. Each page records multiple transactions and is dated. But unlike a physical ledger where you could tear out a page or use correction fluid, each page in the blockchain also contains a mathematical reference to the previous page, linking them inseparably.

The Chain: How Blocks Connect and Stay Secure

Here’s where blockchain becomes nearly impossible to hack. Each new block doesn’t just contain its own information – it also includes the unique identifier (hash) from the previous block. This creates a chain of mathematical dependencies.

Imagine you wanted to change an old transaction from six months ago. You’d have to:

- Change that specific block

- Recalculate its hash (which changes because you modified the content)

- Update the next block, which references the old hash

- Recalculate that block’s hash

- Continue this process for every single block created since then

- Do all of this faster than the network creates new blocks

- Convince over 50% of the network computers to accept your altered version

This is computationally impossible for established blockchains, which is why blockchain technology is considered so secure.

What Is Decentralization in Blockchain?

Here’s where blockchain gets revolutionary. Instead of one company or government keeping the official records (like your bank manages your account), thousands of computers across the world each keep an identical copy of the entire blockchain. This distribution of record-keeping is called decentralization.

When Sarah sends money to James:

- Thousands of independent computers receive the announcement

- Each computer independently verifies the transaction is valid

- They all add the transaction to their copy of the blockchain simultaneously

- No single entity controls or can manipulate the system

If a hacker wanted to change the historical record, they’d need to simultaneously hack and alter more than half of these thousands of computers spread across different countries, owned by different people, running different security systems. This makes successful attacks virtually impossible on major blockchain networks.

Compare this to a traditional bank database where all the records are in one place. If that central database is compromised, all the records could be changed. With blockchain’s decentralized structure, there’s no single point of failure.

How Blockchain Verifies Transactions (The Real Process)

You might be wondering: if there’s no central authority, how do all these computers agree on what’s valid and what isn’t? This is handled through something called a “consensus mechanism” – a set of rules that helps the network reach agreement.

Different blockchains use different methods. Bitcoin uses “proof-of-work,” where computers compete to solve complex mathematical puzzles, and the winner gets to add the next block. Newer systems like Ethereum now use “proof-of-stake,” where participants are chosen to validate transactions based on how much cryptocurrency they hold and are willing to “stake” as collateral.

The specific mechanism isn’t important for beginners to understand deeply. What matters is knowing that blockchain networks have automated, mathematical ways of reaching consensus without human intermediaries making judgment calls.

Key Features That Make Blockchain Technology Special

Now that you understand how blockchain works, let’s explore the characteristics that make it unique. These five features explain why companies are investing billions in blockchain technology and why it’s being called one of the most transformative innovations since the internet.

Transparency: Why Everyone Can See the Records

Every transaction recorded on a public blockchain is visible to anyone who wants to look. You can literally see every Bitcoin transaction ever made since 2009. This radical transparency might seem strange at first – don’t we want financial privacy?

Here’s the clever part: while the transactions are transparent, the identities behind them can remain private. You can see that wallet address “1A1zP1…” sent 10 Bitcoin to wallet address “3FZbgi…,” but you don’t necessarily know that the first address belongs to Alice and the second to Bob. Users are identified by cryptographic addresses rather than real names.

This transparency serves several purposes. It allows anyone to verify that the system is working correctly without needing to trust an authority. It makes fraud much more difficult because everything is visible. And it creates an audit trail that can be incredibly valuable for supply chains, compliance, and accountability.

Immutability: Why Blockchain Can’t Be Changed or Hacked

Once information is recorded on a blockchain and enough time has passed (usually 6-10 blocks for Bitcoin), it becomes practically impossible to alter. This permanence is called immutability, and it’s one of blockchain’s most powerful features.

Traditional databases can be edited by administrators. Your bank can reverse a transaction. A government can modify records. A company can delete embarrassing information. Sometimes this flexibility is good – mistakes can be corrected. But it also means records can be manipulated, whether for legitimate reasons or fraudulent ones.

With blockchain, what’s written is written permanently. This immutability has fascinating implications. It means historical records can be trusted completely. It means no one can go back and change the rules after the fact. It means accountability is built into the system itself.

Of course, immutability also has drawbacks. If you accidentally send cryptocurrency to the wrong address, there’s no “undo” button or customer service to call. The transaction is permanent. This is why blockchain systems require users to be more careful and take more responsibility for their actions.

Security: How Blockchain Protects Your Data

Blockchain security comes from multiple layers working together. First, there’s cryptographic protection – each transaction is secured using advanced mathematical techniques that would take millions of years for even supercomputers to break. Second, there’s the distributed nature of the network. Unlike a centralized system where hacking one server compromises everything, blockchain requires attacking thousands of independent nodes simultaneously.

Third, there’s the transparency we discussed earlier. Because everyone can see all transactions, suspicious activity is more likely to be noticed and investigated. Fourth, there’s the consensus mechanism that prevents any single participant from unilaterally making changes.

Is blockchain 100% secure? No technology is. But blockchain’s security model represents a significant improvement over traditional centralized systems for many use cases, particularly those involving trust between parties who don’t know each other.

Decentralization vs. Traditional Databases

Let’s directly compare blockchain to traditional databases to understand the tradeoffs:

| Feature | Traditional Database | Blockchain |

| Control | Centralized (single authority manages it) | Decentralized (distributed across many participants) |

| Access | Limited to authorized users only | Transparent (public blockchains) or permissioned |

| Modification | Can be edited or deleted by administrators | Immutable (cannot be changed once confirmed) |

| Verification | Trust the central authority | Mathematical consensus among network participants |

| Security | Single point of failure risk | Distributed across thousands of nodes |

| Speed | Very fast (centralized processing) | Slower (requires network-wide consensus) |

| Scalability | Easily handles millions of transactions | More challenging at massive scale |

| Cost | Lower operational costs | Higher due to redundancy and energy use |

Neither system is universally “better” – each has its place. Traditional databases work great when you have a trusted central party and need speed and efficiency. Blockchain excels when you need trustless verification, transparency, and permanence across organizational boundaries.

Real-World Blockchain Applications Beyond Cryptocurrency

While Bitcoin introduced blockchain to the world, the technology has far broader applications. Blockchain is already being used in industries having nothing to do with cryptocurrency, solving real problems for major companies and organizations. Let’s explore where blockchain technology is making an impact today.

Blockchain in Supply Chain: From Farm to Table Tracking

Walmart uses blockchain to track food from farms to store shelves, and the results are remarkable. When contaminated lettuce caused an E. coli outbreak in 2018, it previously took seven days to trace the source of the contamination. With blockchain tracking, Walmart reduced this time to 2.2 seconds.

Here’s how it works: Every time a product changes hands in the supply chain, that transaction is recorded on the blockchain. The lettuce is harvested at Farm A – recorded. Shipped to Processing Facility B – recorded. Sent to Distribution Center C – recorded. Delivered to Store D – recorded. Each step includes details like temperature logs, handling procedures, and quality inspections.

When there’s a problem, you don’t need to investigate every farm, truck, and warehouse that handled lettuce in the past month. You can instantly trace the exact path of the contaminated batch, identify which specific farm it came from, and remove only the affected products from shelves.

Companies like Maersk use similar blockchain systems to track shipping containers globally, reducing paperwork, preventing fraud, and ensuring that your package’s supposed journey from China to Chicago actually happened as claimed. The diamond industry uses blockchain to verify that stones aren’t “blood diamonds” funding conflicts. Fashion brands use it to prove their products aren’t counterfeits.

Healthcare: How Blockchain Secures Medical Records

Your medical records are scattered across different doctors, hospitals, pharmacies, and insurance companies. Each maintains their own database, often unable to easily share information with the others. This fragmentation leads to repeated tests, dangerous drug interactions missed, and delays in emergency treatment.

Blockchain offers a solution: patients could control a unified medical record stored on a blockchain, granting access to different providers as needed. The record would be complete, tamper-proof, and instantly accessible in emergencies. Estonia has already implemented a blockchain-based system for health records, giving citizens control over their medical data while ensuring privacy and security.

Research institutions are exploring blockchain for clinical trials, where data integrity is crucial. By recording trial data on a blockchain, researchers can prove that results haven’t been manipulated or selectively reported, increasing trust in medical research.

Voting Systems: Can Blockchain Make Elections Tamper-Proof?

Elections depend entirely on trust in the counting process. Blockchain voting systems propose recording votes on an immutable public ledger where anyone can verify the count was done correctly, while maintaining voter privacy through cryptographic techniques.

Several countries and organizations have experimented with blockchain voting. West Virginia used it for overseas military voters. The city of Moscow implemented it for local elections. While promising, blockchain voting faces significant challenges around security, accessibility, and verifying voter identity digitally.

Said technology isn’t mature enough yet for widespread national elections, but it represents an interesting potential future for democratic processes.

Real Estate: Faster, Cheaper Property Transfers

Buying property currently involves title companies, lawyers, banks, government registries, and weeks or months of paperwork to verify ownership and transfer it legally. Each intermediary takes a cut, and the process is expensive and slow.

Several countries are experimenting with recording property titles on blockchain. Sweden’s land registry authority has tested blockchain for property transactions, reducing the process from months to days. In countries with weak or corrupt land registry systems, blockchain offers a way to establish clear, tamper-proof ownership records that can’t be disputed or erased by corrupt officials.

Smart contracts (self-executing agreements on blockchain) could automate much of the transfer process. When conditions are met – payment received, inspection completed, mortgage approved – the property title automatically transfers to the new owner without extensive paperwork or intermediary fees.

Digital Identity: Taking Control of Your Personal Data

You probably have dozens of online accounts, each with a username and password, each requiring you to share personal information. Companies store this data in centralized databases that regularly get hacked, leaking millions of identities.

Blockchain-based identity systems would let you control your own data. Instead of giving Facebook, Google, and Amazon copies of your information, you’d store it securely and grant temporary access when needed. Want to prove you’re over 21? Your blockchain identity confirms this without revealing your actual birthdate or other sensitive details.

Several countries are developing blockchain national ID systems. Africa is exploring blockchain identity to help the millions without official documentation access banking and government services. While still early-stage, this represents a fundamental reimagining of how we manage identity in the digital age.

Blockchain vs Cryptocurrency: Understanding the Difference

Many beginners think blockchain and cryptocurrency are the same thing. They’re not – and understanding the difference is crucial for anyone learning about this technology.

Is Blockchain the Same as Bitcoin? (No, Here’s Why)

Blockchain and Bitcoin are not the same thing. Here’s the relationship explained simply:

Blockchain is the underlying technology (the platform)

Bitcoin is one application that uses blockchain (like an app)

Think of it like the internet and email:

- The internet is the infrastructure that connects computers globally

- Email is just one application that runs on the internet

- The internet has thousands of other uses beyond email – websites, video streaming, cloud storage, gaming

Similarly:

- Blockchain is the infrastructure for recording and verifying transactions

- Bitcoin is just one application that runs on blockchain technology

- Blockchain has thousands of potential uses beyond Bitcoin – supply chains, medical records, voting, property titles, and many more

Bitcoin was the first application of blockchain technology, created in 2009. Because Bitcoin became famous first, many people mistakenly think blockchain only means cryptocurrency. But that would be like thinking the internet only means email because email was one of its first popular uses.

How Cryptocurrency Uses Blockchain Technology

Cryptocurrencies use blockchain to solve a specific problem: how can digital money work without a central bank? Physical cash is easy – you can hand someone a $20 bill, and now they have it and you don’t. But digital information can be copied infinitely. How do you prevent someone from spending the same digital dollar twice?

Blockchain solves this “double-spending problem” by maintaining a public ledger of who owns what. When you send someone Bitcoin, the blockchain network verifies you actually own that Bitcoin, records the transfer, and updates everyone’s copy of the ledger. The Bitcoin now belongs to the recipient, and you can’t spend it again because the network knows you already transferred it.

Ethereum, another major cryptocurrency, extended this concept by adding programmable “smart contracts” – agreements that automatically execute when conditions are met, no lawyers or intermediaries needed. This opened blockchain to applications far beyond simple money transfers.

Other Blockchain Applications You Should Know

Beyond cryptocurrency, blockchain enables several revolutionary concepts:

Smart contracts are self-executing agreements written in code. When conditions are met, the contract automatically enforces itself. Imagine a rental agreement where the smart lock on your apartment door automatically opens when your rent payment is confirmed on the blockchain – no landlord or property manager needed.

Non-Fungible Tokens (NFTs) use blockchain to prove ownership of unique digital items like art, music, or collectibles. While NFTs became famous for expensive digital art sales, they have practical uses too: concert tickets that can’t be counterfeited, game items that players truly own, or certificates of authenticity for luxury goods.

Decentralized Finance (DeFi) recreates banking services – loans, savings accounts, trading – using blockchain and smart contracts instead of banks. While controversial and risky, DeFi represents an experiment in financial systems that don’t require traditional institutions.

These applications all use blockchain technology but have nothing to do with cryptocurrency as money. This diversity shows why understanding the distinction between blockchain and cryptocurrency matters.

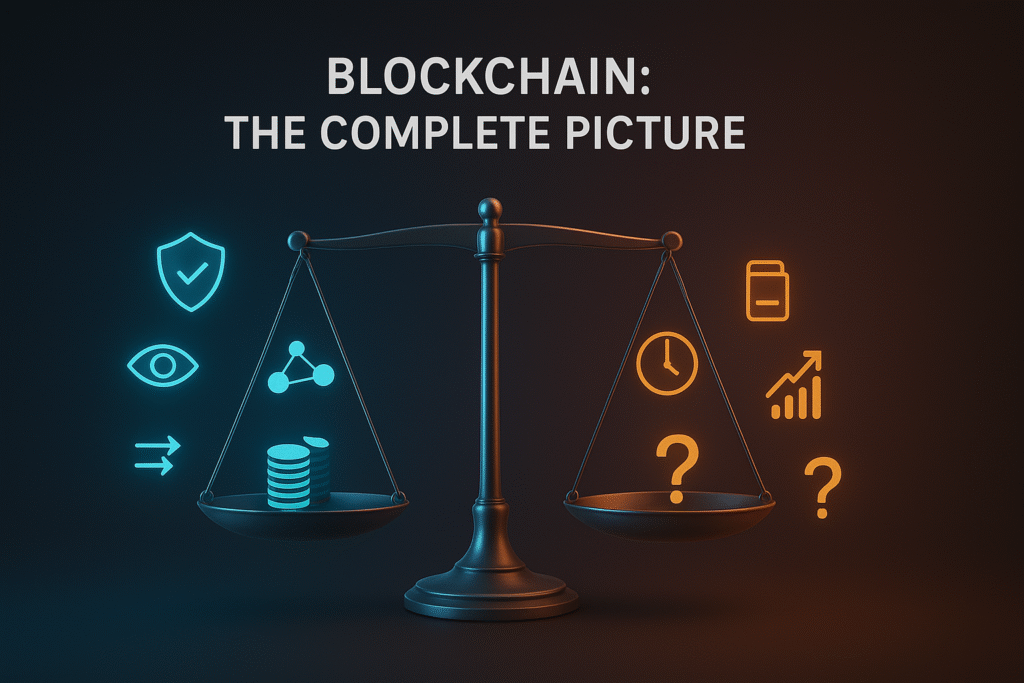

Advantages and Disadvantages of Blockchain Technology

Every technology has tradeoffs. Blockchain solves significant problems but also comes with limitations. Here’s an honest assessment of both – understanding these helps you evaluate when blockchain makes sense and when traditional solutions might work better.

Benefits of Blockchain: Why Companies Are Adopting It

Enhanced Security: Distributed networks are fundamentally harder to hack than centralized systems. Even if one node is compromised, the network remains secure. Cryptographic protection makes transactions virtually impossible to forge. For industries handling sensitive data or high-value transactions, this security model is compelling.

Transparency and Traceability: All transactions are visible and verifiable by participants, reducing fraud and increasing accountability. For supply chains, this means tracking products from origin to consumer. For auditing, this means reviewable records that can’t be secretly altered. Transparency builds trust where it’s currently lacking.

Reduced Costs: Eliminating intermediaries – banks, clearinghouses, lawyers, administrators – cuts transaction fees and processing expenses. When multiple organizations need to coordinate, blockchain can replace expensive middle-layer systems with automated verification. Over time, these savings can be substantial.

Faster Transactions: Cross-border payments that take three to five business days through traditional banking can settle in minutes on blockchain. For time-sensitive industries, this speed advantage changes business models and enables new possibilities.

Increased Trust Without Authority: Mathematical verification replaces the need to trust institutions or individuals. This matters enormously in situations involving parties who don’t know each other, cross-border transactions where legal systems differ, or regions with weak or corrupt institutions.

Permanent Records: Every transaction has a complete, immutable history. This is valuable for compliance, legal evidence, historical research, and any situation where provenance matters. You can prove exactly what happened and when without relying on a central authority’s version of events.

Blockchain Limitations: The Honest Challenges

Energy Consumption: Some blockchains, especially Bitcoin’s proof-of-work system, use massive amounts of electricity – comparable to the annual energy consumption of entire countries. This environmental impact is blockchain’s most serious criticism. However, newer systems like Ethereum’s proof-of-stake use 99.95% less energy, showing the problem isn’t inherent to blockchain but to specific implementation choices.

Slower Speed: Processing transactions through network consensus is significantly slower than centralized databases. Bitcoin handles roughly 7 transactions per second compared to Visa’s 24,000. For applications requiring high-speed processing, current blockchain technology can’t compete with traditional systems.

Scalability Challenges: As blockchains grow, storing the entire history on every node becomes problematic. Bitcoin’s blockchain is now over 400GB. Ethereum exceeds 1TB. This storage requirement limits who can participate in running a full node. Various “Layer 2” solutions aim to address this, but scalability remains an ongoing challenge.

Irreversibility: While immutability is usually a feature, it becomes a bug when mistakes happen. Send cryptocurrency to the wrong address? There’s no customer service to call, no bank to reverse the charge. The transaction is permanent. This unforgiving nature means users bear more responsibility and risk.

Learning Curve and Complexity: Understanding and implementing blockchain requires significant technical knowledge, slowing mainstream adoption. Most people don’t understand how blockchain works, making them hesitant to trust it. This educational gap will take years to bridge.

Regulatory Uncertainty: Laws governing blockchain vary dramatically by country and are constantly evolving. This uncertainty makes businesses hesitant to invest heavily in blockchain solutions that might run afoul of future regulations. Legal frameworks haven’t caught up with the technology.

Cost of Operation: While blockchain can reduce some costs, it increases others. Running thousands of redundant nodes, performing complex cryptographic operations, and storing complete transaction histories for everyone isn’t free. For many applications, centralized databases remain more cost-effective.

Energy Consumption and Environmental Concerns

The energy debate deserves special attention because it’s blockchain’s most contentious issue. Bitcoin mining currently uses about 150 terawatt-hours annually – more than many countries. This comes primarily from proof-of-work systems where computers compete to solve mathematical puzzles, with only one winner but everyone using electricity.

However, the industry is responding. Ethereum’s 2022 switch to proof-of-stake reduced its energy consumption by over 99%. Many newer blockchains use more efficient consensus mechanisms from the start. Some mining operations use renewable energy or even capture wasted gas from oil fields.

The counterargument from blockchain advocates: compare blockchain’s energy use not to zero but to what it replaces. The traditional financial system – with all its bank buildings, ATMs, servers, and offices – also consumes enormous energy. Whether blockchain is better or worse depends on the specific comparison and application.

This remains an active area of development and debate. Anyone considering blockchain solutions should evaluate energy efficiency as a serious factor in their decision.

What This Means for Your Future (Industry Impact)

How Blockchain Might Affect Your Job or Industry

If you work in finance, healthcare, logistics, real estate, legal services, government, or tech – blockchain will likely impact your career within the next 5-10 years. Not necessarily in a “robots taking jobs” way, but in changing how you verify information, process transactions, and establish trust with clients and partners.

Financial professionals might work with blockchain-based settlement systems, reducing back-office workload but requiring new technical skills. Supply chain managers might use blockchain to track shipments and verify supplier claims. Healthcare administrators might manage patient consent for sharing blockchain-stored records. Lawyers might oversee smart contracts that execute automatically. Even creative professionals are encountering blockchain through NFTs and digital rights management.

Even if blockchain remains behind the scenes – invisible infrastructure you never directly interact with – understanding the basics positions you as forward-thinking in your field. When your company considers blockchain pilots, or partners propose blockchain solutions, you’ll be the person who can cut through the hype and evaluate whether it actually makes sense.

The jobs directly in blockchain (developers, security auditors, system architects) are growing rapidly and pay well because the talent shortage is acute. But the broader impact is how blockchain becomes another tool in many professionals’ toolkits, like how most jobs eventually required some computer literacy.

The Next 5-10 Years: Predictions and Trends

Looking ahead, several trends seem likely to shape blockchain’s evolution:

Central Bank Digital Currencies (CBDCs) are blockchain-based currencies issued by governments. China is already testing a digital yuan. The European Central Bank is developing a digital euro. The U.S. Federal Reserve is researching a digital dollar. These will bring blockchain technology into mainstream finance, though in more controlled forms than Bitcoin enthusiasts initially envisioned.

Enterprise adoption is accelerating quietly. Major corporations are testing blockchain for internal processes and B2B transactions rather than flashy consumer-facing applications. This unglamorous use of blockchain for supply chains, financial settlement, and inter-company coordination may prove more transformative than cryptocurrency speculation.

Identity management systems built on blockchain could change how we prove who we are online, potentially reducing fraud while increasing privacy. Several countries are piloting national ID systems on blockchain.

Interoperability between different blockchains will improve. Currently, blockchains are often isolated – Bitcoin can’t directly talk to Ethereum, which can’t talk to other networks. Cross-chain bridges and standards will make the ecosystem more connected.

Regulation will mature, providing clearer rules about what’s legal and how blockchain systems must operate. This clarity will actually accelerate adoption by reducing legal uncertainty.

Will blockchain “change everything”? Probably not in the revolutionary sense initially predicted. But it will likely become another important tool for specific use cases where its unique properties – decentralization, immutability, transparency – solve real problems better than alternatives. That’s still a significant impact, just more gradual and less dramatic than early evangelists suggested.

Frequently Asked Questions About Blockchain

Can blockchain be hacked?

While individual blockchain accounts can be compromised through user error (like password theft or phishing scams), the blockchain network itself is extremely difficult to hack due to its distributed nature. To alter a blockchain, a hacker would need to simultaneously control 51% or more of the network’s computing power – practically impossible for major blockchains like Bitcoin or Ethereum with thousands of independent nodes. However, smaller blockchains with fewer participants can be more vulnerable to these “51% attacks.” The larger and more distributed the network, the more secure it becomes.

Is blockchain the same as Bitcoin?

No, blockchain and Bitcoin are not the same thing. Blockchain is the underlying technology – a method of recording and verifying data – while Bitcoin is just one application that uses blockchain technology. Think of it like the internet versus email: email uses internet technology, but the internet has many other uses beyond email. Similarly, Bitcoin uses blockchain technology, but blockchain has countless applications beyond cryptocurrency, including supply chain tracking, medical records, voting systems, and more.

What problems does blockchain solve?

Blockchain solves trust problems in situations where parties need to coordinate but don’t want to rely on a central authority. Specifically, it provides transparency (everyone can see transactions), security (data is protected and distributed), immutability (records can’t be changed), and verification without intermediaries (no need for banks, notaries, or other middlemen). This makes blockchain useful for supply chain tracking, secure medical records, tamper-proof voting, verifying product authenticity, establishing digital identity, and any situation where you need trustworthy records but don’t want a single organization controlling everything.

Who invented blockchain technology?

Bitcoin’s blockchain was invented by someone using the pseudonym Satoshi Nakamoto, who published the Bitcoin whitepaper in 2008 and launched the network in 2009. Satoshi’s true identity remains unknown – it could be an individual or a group of people. However, the concepts behind blockchain (cryptographic hashing, distributed systems, digital signatures) existed before Bitcoin. Satoshi’s innovation was combining these existing technologies in a novel way to create a decentralized digital currency that actually worked.

How secure is blockchain compared to traditional systems?

Blockchain security comes from distribution rather than central protection. Traditional systems put all data in one place protected by firewalls and encryption – if hackers breach that defense, they access everything. Blockchain spreads identical copies across thousands of computers, requiring attackers to compromise over half simultaneously, which is exponentially harder. However, this doesn’t make blockchain invulnerable. Individual users can make mistakes (losing passwords, falling for scams), smart contracts can have bugs, and smaller blockchain networks can be attacked. The security model is fundamentally different rather than universally stronger – it excels in some situations and has its own vulnerabilities in others.

Why is blockchain important for the future?

Blockchain is important because it fundamentally changes how we establish trust in digital transactions. Instead of relying on banks, governments, or tech companies to verify information and act as neutral intermediaries, blockchain creates a system where trust emerges from mathematical consensus and transparency. This could reduce costs, increase efficiency, and enable new forms of organization in finance, supply chains, healthcare, governance, and many other fields. Whether blockchain becomes as transformative as the internet or finds its niche in specific industries, it represents a genuine innovation in how humans coordinate and exchange value.

What are the main disadvantages of blockchain?

Blockchain’s main disadvantages include high energy consumption (especially for proof-of-work systems like Bitcoin), slower transaction speeds compared to centralized databases, scalability challenges as the network grows, and a steep learning curve for both users and developers. Additionally, the immutability that makes blockchain secure also means errors can’t be easily corrected – send money to the wrong address, and it’s gone permanently. The technology is still maturing, so many applications face regulatory uncertainty and lack user-friendly interfaces. For many use cases, traditional databases remain more practical, faster, and cheaper.

Where is blockchain used today?

Blockchain is currently used in several major industries beyond cryptocurrency. Walmart and Maersk track supply chains on blockchain to verify product origins and detect contamination. Estonia uses blockchain for healthcare records and digital identity. West Virginia has tested blockchain voting for overseas military personnel. The diamond industry uses it to verify stones aren’t conflict diamonds. Fashion brands use it to fight counterfeiting. Major banks are testing blockchain for international settlement to reduce costs and speed. While many applications are still pilots rather than full deployment, blockchain is moving from experimental technology to real-world infrastructure in specific sectors where its properties solve genuine problems.

Next Steps: Continue Your Blockchain Learning Journey

You now understand what blockchain is, how it works, and why it matters. You’ve learned that blockchain is the infrastructure (not just cryptocurrency), seen real-world applications beyond Bitcoin, and understand both the revolutionary potential and honest limitations of this technology.

More importantly, you can now explain blockchain to friends in your own words – which was the goal of this blockchain for beginners guide. That ability to understand and articulate concepts is what separates those who merely heard buzzwords from those who genuinely comprehend a new technology.

Blockchain is still evolving rapidly. You’re early to understanding this technology, which positions you ahead of most people. Whether blockchain becomes as transformative as the internet or finds its niche in specific industries, you’re now equipped to follow the story with informed curiosity rather than confused bewilderment.

The blockchain space moves fast. What’s cutting-edge today becomes foundational tomorrow. Continuous learning isn’t optional – it’s how you stay relevant as this technology matures and creates new opportunities.

About This Guide

This comprehensive guide was created to make blockchain technology accessible to complete beginners without requiring technical background. The explanations prioritize clarity and real-world understanding over technical precision.

Last Updated: November 2025

Sources: This guide was researched using authoritative sources including the original Bitcoin whitepaper by Satoshi Nakamoto, IBM Blockchain documentation, academic research, and real-world case studies from companies implementing blockchain solutions.

This content is educational only and does not constitute financial or investment advice. Cryptocurrency and blockchain investments carry significant risk.

Reference

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Retrieved from https://bitcoin.org/bitcoin.pdf

IBM. (2025). Blockchain explained. IBM Blockchain Solutions. Retrieved from https://www.ibm.com/topics/blockchain

Walmart. (2018). Walmart’s food traceability initiative based on IBM Food Trust. Walmart Corporate Newsroom. Retrieved from https://corporate.walmart.com/newsroom/innovation/20180924/walmart-introduces-new-blockchain-powered-food-traceability-initiative

Maersk & IBM. (2018). TradeLens: Digitizing global trade with blockchain. Retrieved from https://www.tradelens.com

Republic of Estonia. (2025). e-Estonia: Blockchain technology. e-Estonia Briefing Centre. Retrieved from https://e-estonia.com/solutions/security-and-safety/ksi-blockchain

Ethereum Foundation. (2022). The Merge: Ethereum’s transition to proof-of-stake. Retrieved from https://ethereum.org/en/upgrades/merge

World Economic Forum. (2020). Blockchain beyond the hype: A practical framework for business leaders. Retrieved from https://www.weforum.org/reports/blockchain-beyond-the-hype

MIT Technology Review. (2025). Blockchain explained. Retrieved from https://www.technologyreview.com/topic/blockchain

De Beers Group. (2021). Tracr: Blockchain-based diamond traceability platform. Retrieved from https://www.debeersgroup.com/innovation/tracr

6 Comments

Pingback: What Is a Crypto Wallet? Complete Guide to Types, Security & the Right One

Pingback: Dubai & Binance Unite to Bring Crypto Payments Into Global Trade Customs - cryptogiant

Pingback: Revolut Integrates TRON, Ushering In a New Era of European Digital Finance - cryptogiant

Pingback: What Are Smart Contracts? Beginner’s Guide With Examples

Pingback: Ethereum Active Addresses Hit 7-Month Low as Demand Cools - cryptogiant

Pingback: MetaMask Adds Native Bitcoin Support in Major Multichain Push - cryptogiant